Well-designed life insurance policies can help offer you the peace of mind that expenses like mortgages, debts, children’s tuition, and any loss of income may be taken care of when you’re not here.

Depending on the type of insurance you get, how well it is designed, and how effectively it is managed, life insurance can also be the foundation of a sound financial plan to help with expenses during your life.

You probably already know that life insurance may help provide financial protection for your family in the event of your passing. Your beneficiaries (people you choose) will receive money to use as they see fit, helping provide financial support in at a difficult time.

However, it may be the benefits you can receive during your life that make a well-designed life insurance policy important to consider.

These living benefits provided by life insurance can be highly valuable, partly because of the contractual obligations you get from highly regulated insurance carriers. These provide you benefits few other asset or asset class can.

Like most professional services, the person guiding you through the process can ultimately determine the outcome. US Life professionals are licensed to maximize the potential of life insurance as an asset for you.

We have a rigorous training program for all new hires and ongoing education for all team members. We are highly selective on which carriers and products we suggest and have team members dedicated to evaluating new offerings.

Not all life insurance policies are created equal. There are seemingly endless possibilities in carriers and products on the market, and they are constantly being updated.

If you are counting on this asset to have optimal performance for you and your loved ones, it is absolutely essential that the policy design fits your needs today and provides the flexibility and control necessary to change as life’s needs do.

Yes, in two ways. Some policies, like whole life insurance, build cash value over time that you can use throughout your life.

Dividends (while not guaranteed, many carriers have consistently paid them every year since about the 1870s) can be taken out as cash, used to pay premiums, or to buy more coverage.

You have a contract with a top-rated organization that guarantees you certain benefits.

Many life insurance policies have a 0% “loss floor,” where the minimum rate of return is 0%. It cannot be negative.

Many life insurance products offer you and your life insurance professional tremendous control to account for life’s changes.

Many life insurance products offer you and your life insurance professional tremendous control to account for lifes changes.

You will have annual opportunities to review the progress of your policy and make any necessary changes.

Often, life insurance policies will enable you to access accumulated cash values via a tax-free loan for various life needs and emergencies. **

You are in control of where your death benefit goes and can amend your desires throughout the life of your policy.

Life insurance policies can offer benefits for business owners, from potential tax benefits to employee retention.

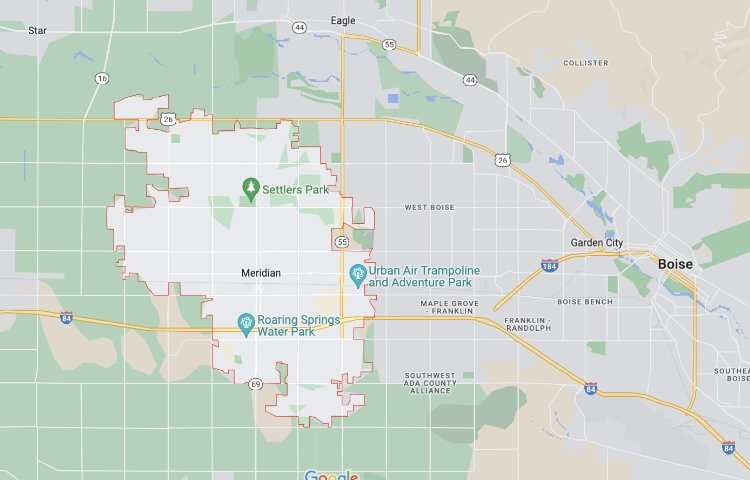

2929 W. Navigator Dr. Suite 300, Meridian, ID 83642*

208-297-7168*

208-297-7168*

Support@USLifePro.com*

Support@USLifePro.com*

2929 W. Navigator Dr. Suite 300, Meridian, ID 83642*

208-297-7168*

208-297-7168*

Support@USLifePro.com*

Support@USLifePro.com*

The Flexmethod is a system designed to fully utilize the characteristics of insurance policies. Insurance services are offered through the Stafford Corporation (“Stafford”), doing business as “US Life”, which is a licensed insurance producer in Idaho and offers insurance products and services through its licensed insurance brokers. Certain eligibility restrictions may apply. In connection with the strategies you may discuss with your US Life advisor, Stafford may incorporate the services of affiliated service providers. The compensation earned by these entities presents a conflict of interest for Stafford because Stafford is incentivized to use or recommend that you use these affiliated service providers. The statements contained herein are aspirational in nature and for illustrative purposes only. The suitability of all US Life strategies and their potential results will depend on the facts and circumstances of the individual policyholder and future economic conditions that are impossible to know in advance.

There are risks associated with asset backed lending strategies that you should consider and discuss with your US Life representative and other financial professionals, including, but not limited to, policy performance, interest rate risk, and additional loan renewal requirements. Any guarantees and benefits of an insurance policy are subject to the claims-paying ability and financial strength of the issuing insurance company. No other guarantees by any other party should be assumed or implied. It is possible coverage will expire when either no premiums are paid following the initial premium, or subsequent premiums are insufficient to continue coverage. Distributions taken through loans and withdrawals will reduce a policy’s cash surrender value and death benefit and may affect policy coverage and performance. In addition, if the policyholder fails to repay any insurance-backed loan pursuant to its terms, the loan could default, the insurance contract could lapse, and the value of the policy could be forfeited. Certain strategies seek to provide access to potentially tax-free withdrawals because loans are generally not considered income; however, you should consult with your tax advisor regarding the specific tax implications of any strategy. Tax implications are possible if a life insurance policy is sold or surrendered. Not all US Life solutions are available in all states or jurisdictions. Please consult with your US Life professional and insurance agent for specific information related to your needs. US Life does business as USL Insurance Services for business conducted in the state of California, Insurance License #0K65443.

Privacy Policy