Whole life insurance can give you level premiums, strong guarantees, and valuable protection. It can also build cash value, which you can access through loans throughout your life.

Stable premiums and accumulated cash value make whole life policies cost effective in the long term, and viable as an estate planning vehicle.

Having a whole life insurance policy may help provide for you throughout your life and provide financial support to your family upon your passing.

Many whole life insurance policies benefits you can use while you're living that may provide your financial plan even more flexibility.

Whole life insurance builds cash value over time that you can use for anything. It can come in handy for unexpected expenses, putting your kids through college, expanding your business, upgrading your home, or as additional income in retirement.

A whole life insurnace policy, if in good standing and managed correctly, can give you the confidence of knowing that there will be lifelong protection for your loved ones, they'll receive a tax-free death benefit when you're no longer here.

A well-designed policy builds cash value that can be used for anything. You also have a chance to earn dividends which you can accept as cash, use to pay premiums, and more.

The death benefit (payout) paid to your loved ones is typically tax-free, and the cash value accumulates tax deferred.

The real question is, can whole life insurance help you attain your financial and lifestyle goals? If the answer is yes, it's worth it.

Whole life insurance is often times highly flexible asset which can be an important part of your financial plan.

A policy which is in good standing, may provide a guaranteed payout when you're no longer here. Additionally it may has more you can use throughout your life. Its cash value is guaranteed to increase, it's tax advantaged, and it's not affected by market fluctuations.

Like all life insurance, your beneficiaries will receive the death benefit typically free of federal income tax, and growth within the policy is tax-deferred.

Once your premiums are set (based on things like the amount of coverage you'll need, your age, and health), what you pay every month (or yearly) is what you'll always pay.

Guaranteed income-tax free death benefit to support your loved ones in time of need and beyond.

Whole life insurance offers a minimum guaranteed return.

So long as you pay your premium, whole life insurance doesn’t have a term; that is, it covers you for your entire life.

A choice of riders or add-on benefits can be used to customize coverage.

Your accumulated cash value can be a supplement to your retirement income,

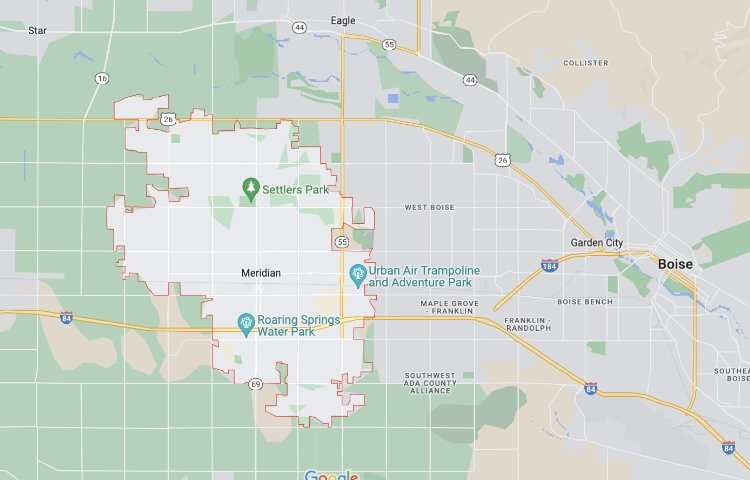

2929 W. Navigator Dr. Suite 300, Meridian, ID 83642*

208-297-7168*

208-297-7168*

Support@USLifePro.com*

Support@USLifePro.com*

2929 W. Navigator Dr. Suite 300, Meridian, ID 83642*

208-297-7168*

208-297-7168*

Support@USLifePro.com*

Support@USLifePro.com*

The Flexmethod is a system designed to fully utilize the characteristics of insurance policies. Insurance services are offered through the Stafford Corporation (“Stafford”), doing business as “US Life”, which is a licensed insurance producer in Idaho and offers insurance products and services through its licensed insurance brokers. Certain eligibility restrictions may apply. In connection with the strategies you may discuss with your US Life advisor, Stafford may incorporate the services of affiliated service providers. The compensation earned by these entities presents a conflict of interest for Stafford because Stafford is incentivized to use or recommend that you use these affiliated service providers. The statements contained herein are aspirational in nature and for illustrative purposes only. The suitability of all US Life strategies and their potential results will depend on the facts and circumstances of the individual policyholder and future economic conditions that are impossible to know in advance.

There are risks associated with asset backed lending strategies that you should consider and discuss with your US Life representative and other financial professionals, including, but not limited to, policy performance, interest rate risk, and additional loan renewal requirements. Any guarantees and benefits of an insurance policy are subject to the claims-paying ability and financial strength of the issuing insurance company. No other guarantees by any other party should be assumed or implied. It is possible coverage will expire when either no premiums are paid following the initial premium, or subsequent premiums are insufficient to continue coverage. Distributions taken through loans and withdrawals will reduce a policy’s cash surrender value and death benefit and may affect policy coverage and performance. In addition, if the policyholder fails to repay any insurance-backed loan pursuant to its terms, the loan could default, the insurance contract could lapse, and the value of the policy could be forfeited. Certain strategies seek to provide access to potentially tax-free withdrawals because loans are generally not considered income; however, you should consult with your tax advisor regarding the specific tax implications of any strategy. Tax implications are possible if a life insurance policy is sold or surrendered. Not all US Life solutions are available in all states or jurisdictions. Please consult with your US Life professional and insurance agent for specific information related to your needs. US Life does business as USL Insurance Services for business conducted in the state of California, Insurance License #0K65443.

Privacy Policy